Integrated Vertex Validator

You can use Vertex Validator as part of Vertex for Marketplaces.

Vertex Validator is the name of the component that validates Tax IDs that are specified by your customers when they buy goods. A valid ID means that the transaction will be processed as a Business-to-Business (B2B) transaction rather than a Business-to-Consumer (B2C) transaction.

Business-to-Business (B2B) transactions are those that occur between two businesses. This can change the tax and liability compared to Business-to-Consumer (B2C) transactions.

To specify a transaction as a B2B transaction, you need to specify the buyer's Tax ID in your requests. You use the the buyer_tax_number field to do so.

If a number is valid, the service will process it as a B2B transaction. If the number is not valid, the service will process it as a B2C transaction.

The buyer_name field is overwritten with name returned by the validation service, when this is available.

Transaction Processing

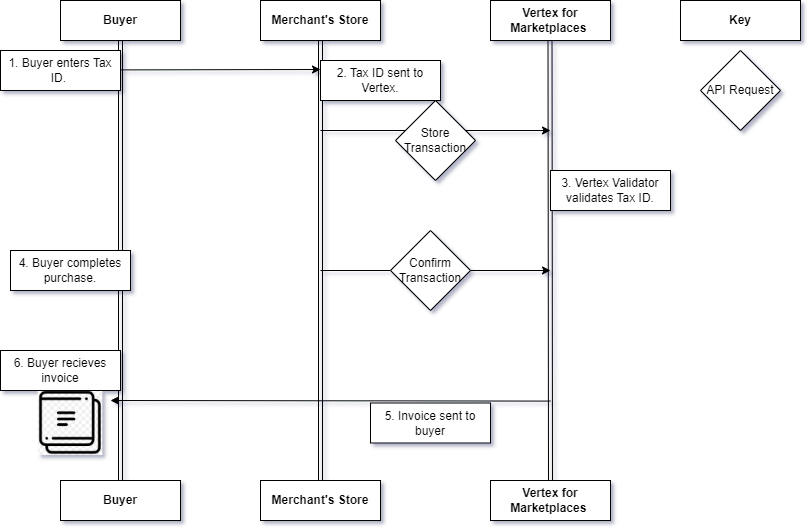

This diagram shows how it can be used with the Store Transaction and Confirm Transaction requests:

The process flow can be as follows. The exact steps can vary in the real world and depend on how the service was integrated with your store or applications:

- Buyer enters Tax ID: A buyer is purchasing a good on the merchant's store. They enter their Tax ID such as a VAT ID during the checkout.

- Tax ID sent to Vertex for Marketplaces: The Tax ID is sent to Vertex for Marketplaces in the

buyer_tax_numberorbuyer_tax_numbersfield of the Store Transaction request. - Vertex Validator validates the Tax ID: Vertex Validator validates the number. The level of the validation can vary from a syntax check to checking the validity of the ID according to the requirements of the applicable Tax Authority.

- Buyer completes purchase: In this example, the validation is successful. The buyer completes the purchase and Store Transaction request is sent to Vertex for Marketplaces.

- Invoice sent to the buyer: This triggers the invoice creation and it is sent to the buyer (as per the configuration in Vertex for Marketplaces). The buyer's name is overwritten with the name retrieved during validation.

- Buyer receives the invoice: The buyer receives an invoice that contains the Tax ID and other relevant information.

Post Processing

Messages

Messages are described in the Message Processing topic.

Reports

You can view details about validation requests in the Tax Number Validations UI.

You can also use the Schedule Report for API-based reporting.

Updated 3 months ago