B2B Reports

Use the B2B reports to provide information about B2B transactions to the Tax Authorities who require it.

Warning

This report is deprecated and should not be used.

The B2B Report tab is available for the following countries:

- Turkey

- India

These countries require that a B2B report is sent to the Tax Authority. The obligation only applies to foreign-based sellers of digital goods. It helps you capture required information like amount, Tax ID and so on.

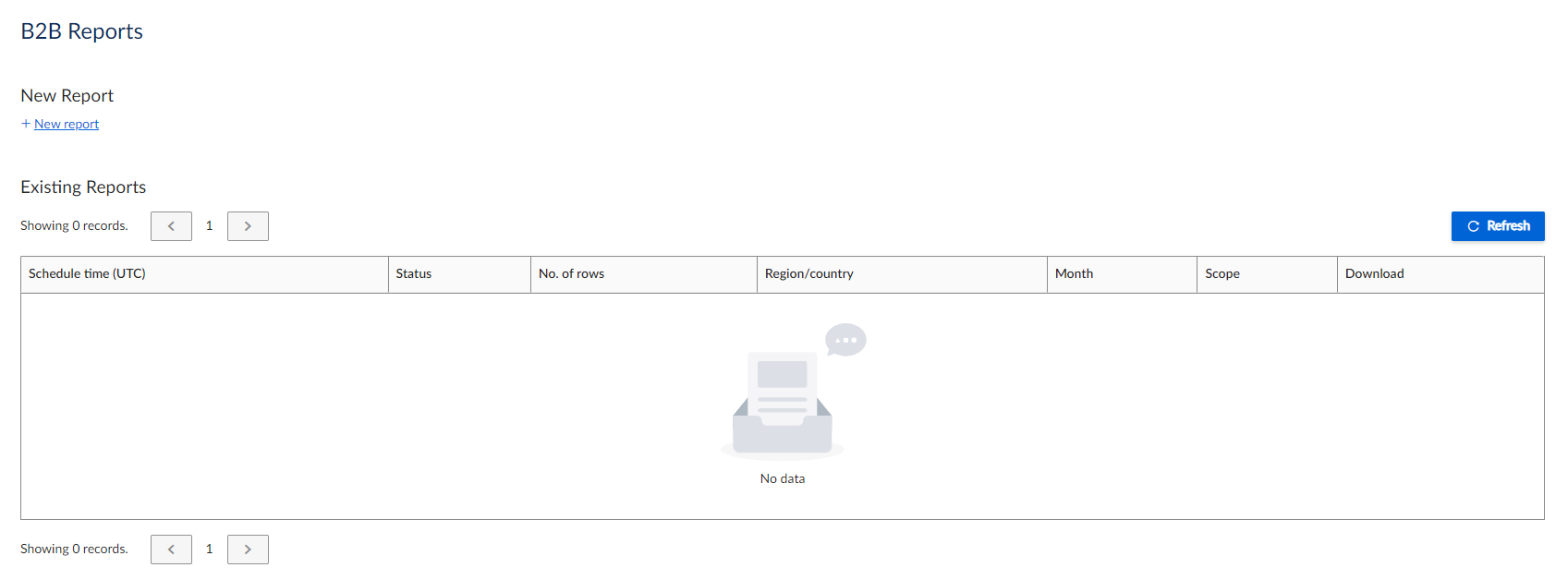

To access it, open the Dashboard and click B2B Reports. The following UI is displayed:

B2B Reports UI

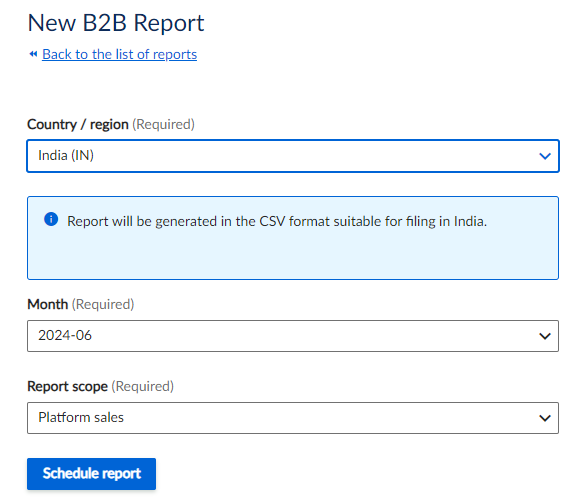

To run a report, click New report and specify the required filters. Click Schedule report to run it.

Restrictions

The following restrictions apply:

- The obligation only applies to foreign-based sellers of digital goods.

- Refunds are not included in these reports.

Filters

The filters are displayed as follows:

B2B Report Filters

The report has the following filters. All of these are mandatory.

| Field | Description |

|---|---|

| Country / Region | The country that you want to run the report on. It is usually India or Turkey. |

| Month | Choose the month to which the report applies. |

| Report scope | For marketplace sales, choose Platform sales. For sales by sellers, choose Platform seller sales. |

Column Headers

The report helps you capture the following information:

| Column Header | Description |

|---|---|

| Scheduled at | The time that the report was scheduled. |

| Status | The status of the report. |

| Number of rows | The number of rows in the report. |

| Country / region | The country or region. |

| Month | The month. |

| Report scope | The scope, either Platform sales or Platform seller sales. |

| Download | The link to download the report. |

Output

The output is in an XML format that is tailored for the reporting needs of each country. You can also choose more generic CSV and XML options.

The report helps you capture the following information:

| Column Header | Description |

|---|---|

| Currency | The currency for Indian reports is Indian Rupee. The currency for Turkey is the Turkish Lira. |

| Amount | As the obligation applies only to foreign-based sellers of digital goods, a reverse charge is applied to all transactions. Therefore no tax is applied and the amount does not include any tax. |

| Tax Country Code | For Indian reports, this will be IN. For Turkish reports, this will be TR. |

| Tax Country Name | India for Indian transactions. Turkey for Turkish transactions. |

| Tax Number | The Tax ID (for example VAT ID) for each transaction. |

| Tax Number Country Code | IN for Indian transactions. TR for Turkish transactions. |

| Invoice Number | The invoice number for each transaction. |

Updated 7 months ago